Español | Tiếng Việt

Orange County Supervisor Andrew Do Announces Plan to Provide $15 Million to OC Small Businesses, Nonprofits & Cities

(June 5, 2020) - Orange County small businesses, nonprofit organizations, and cities will have access to $15 million in stimulus funds, under a stimulus plan authored by Orange County Supervisor Andrew Do.

Small businesses and nonprofits in Santa Ana, Garden Grove, Westminster, Midway City, and Fountain Valley will be able to apply for $10,000 each in economic support grant funding through the CARES Act Funding. In total, $13 million in grant funding will be awarded by lottery to eligible small businesses and nonprofits, with an additional $2 million available to economic development expenses in designated business districts in Santa Ana, Garden Grove, Westminster, and Fountain Valley.

“This plan ensures that stimulus funds quickly help everyone – not just the rich and well-connected,” said Vice Chairman Andrew Do. “Our goal is to help small businesses, self-employed, sole proprietors, family-owned restaurants, and gig economy workers to get back on their feet.”

Last Tuesday, the Orange County Board of Supervisors approved a plan that allocated $75 million in CARES Act funding equally between the five county supervisorial districts for economic support initiatives in response to COVID-19.

“For the past three months, businesses throughout Orange County have been experiencing declining sales, operational challenges, and other financial uncertainties associated with COVID-19,” said Vice Chairman Do.

Out of the $554 million that Orange County received through the CARES Act Funding, $453 was set aside for vital COVID-19 response functions. This includes COVID-19 testing, protective equipment, social programs, and other essential core functions. With the remaining $101 million, $26 million was allocated to cover reimbursements for eligible city costs related to COVID-19, leaving the remaining $75 million to be allocated equally by each of the five supervisorial districts.

Under a previously proposed plan, $75 million would have been given directly to cities based on sales tax revenue, adding yet another layer of bureaucracy to the distribution. This meant that poor cities such as Santa Ana and Westminster would have received fewer benefits from the federal stimulus aid.

Below is an overview of the CARES Act Allocation for the First District.

Overview

The CARES Act allocation of $15 million to the First District for Economic Support will be apportioned as follows:

- $13 million for grants of $10,000 each, to be awarded by lottery to eligible small businesses and nonprofits; and

- $2 million divided amongst the cities of Santa Ana, Garden Grove, Westminster, and Fountain Valley for economic development expenses in designated business districts as determined by each City Council.

- The city allocations cannot be used for projects identified in the cities’ 2019-2020 budgets and must be related to the effects of the COVID-19 pandemic.

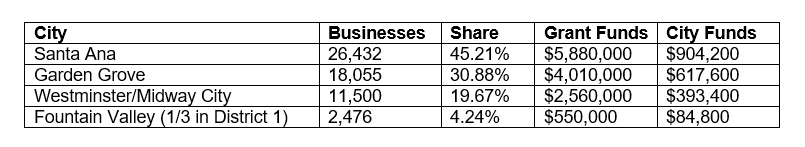

The funds shall be allocated based on the number of non-farm business tax filings reported per city by the Internal Revenue Service, and Orange County Fire Authority data for Midway City, with Midway City’s figures, folded in with the City of Westminster:

Eligibility Requirements Under the Grant Program

Businesses and nonprofits must meet the following eligibility requirements:

- The business or nonprofit must submit an attestation stating that it is impacted by COVID-19, including with a reduction in business activity or temporary closure.

- Home-based businesses are eligible for grant funding.

- Businesses selling CBD or Marijuana, gambling facilities, and strip clubs are not eligible.

- Small businesses or nonprofits with up to 10 Full-Time Equivalent employees.

- Independent contractors are also eligible.

- Businesses and nonprofits must provide documentation to establish proof of place of business in an eligible city. Businesses or nonprofits located in Midway City may apply as part of the City of Westminster’s category.

Eligible Expenses Under the Grant Program

Businesses and nonprofits must use their grants on the following eligible expenses:

- Rent

- Payroll

- Utilities

- Insurance

- Accounts payable

- Personal Protective Equipment

- Inventory

- Office Supplies

- Professional Services (i.e. accounting, janitorial)

- COVID-19 control measures

Grant Administration and Lottery

Managed Care Solutions (MCS), the County’s Workforce Development provider, will conduct the lottery based on a randomized, computer drawing, broken down by eligible city. MCS will work to match, where appropriate, the County’s workforce training programs with businesses funded through this Grant Program. The number of grants awarded in each eligible city will be based on the percent shares listed above.